Discover Aptos' evolving DeFi landscape, exploring innovative developments and upcoming projects that redefine decentralized finance.

What is APTOS?#

Aptos, a relatively new blockchain project with just one year under its belt, is trying to make Web3 accessible to everyone. Built on the innovative smart contract language Move, developed by engineers from Meta's Diem, Aptos boasts a remarkable transaction throughput exceeding 150,000 transactions per second (tps). This accomplishment is attributed to its parallel execution engine and proof-of-stake consensus mechanism.

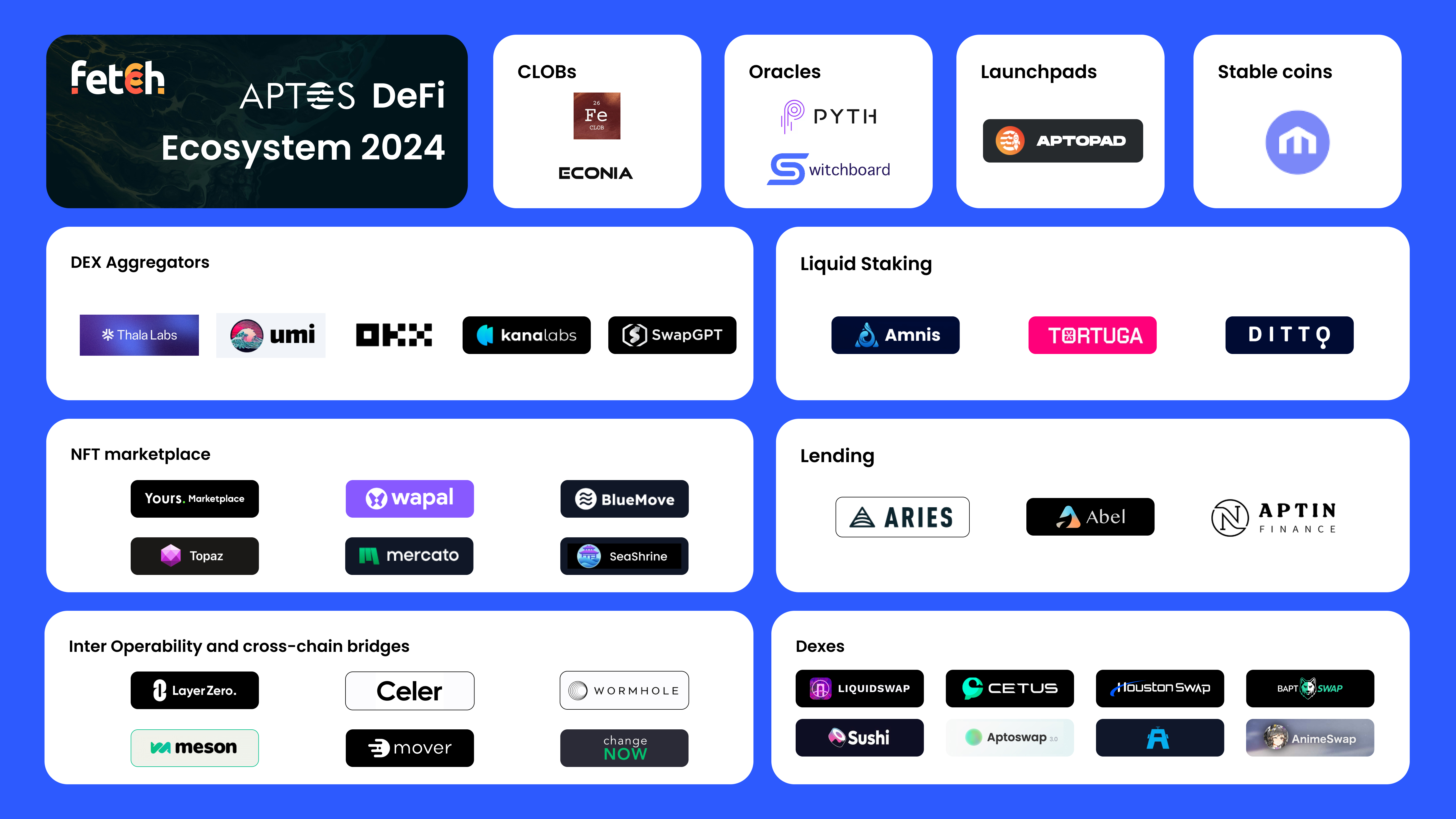

Understanding the DeFi Landscape on Aptos#

Aptos has a vibrant and innovative DeFi ecosystem, fueled by a dynamic community of builders. From cutting-edge trading and investment platforms to revolutionary liquidity protocols and decentralized applications, the ecosystem on Aptos is growing with diversity. This essay aims to deliver a thorough exploration of the DeFi landscape on Aptos, spotlighting key players and emerging trends. Through a careful analysis of project strengths and limitations, we seek to unravel the distinctive offerings of Aptos and its position in comparison to other ecosystems within the expansive realm of decentralized finance.

An Overview of Aptos DeFi: A Closer Look at Crypto Activity #

Overview of Aptos (Data as of 12th Jan, DefiLlama)

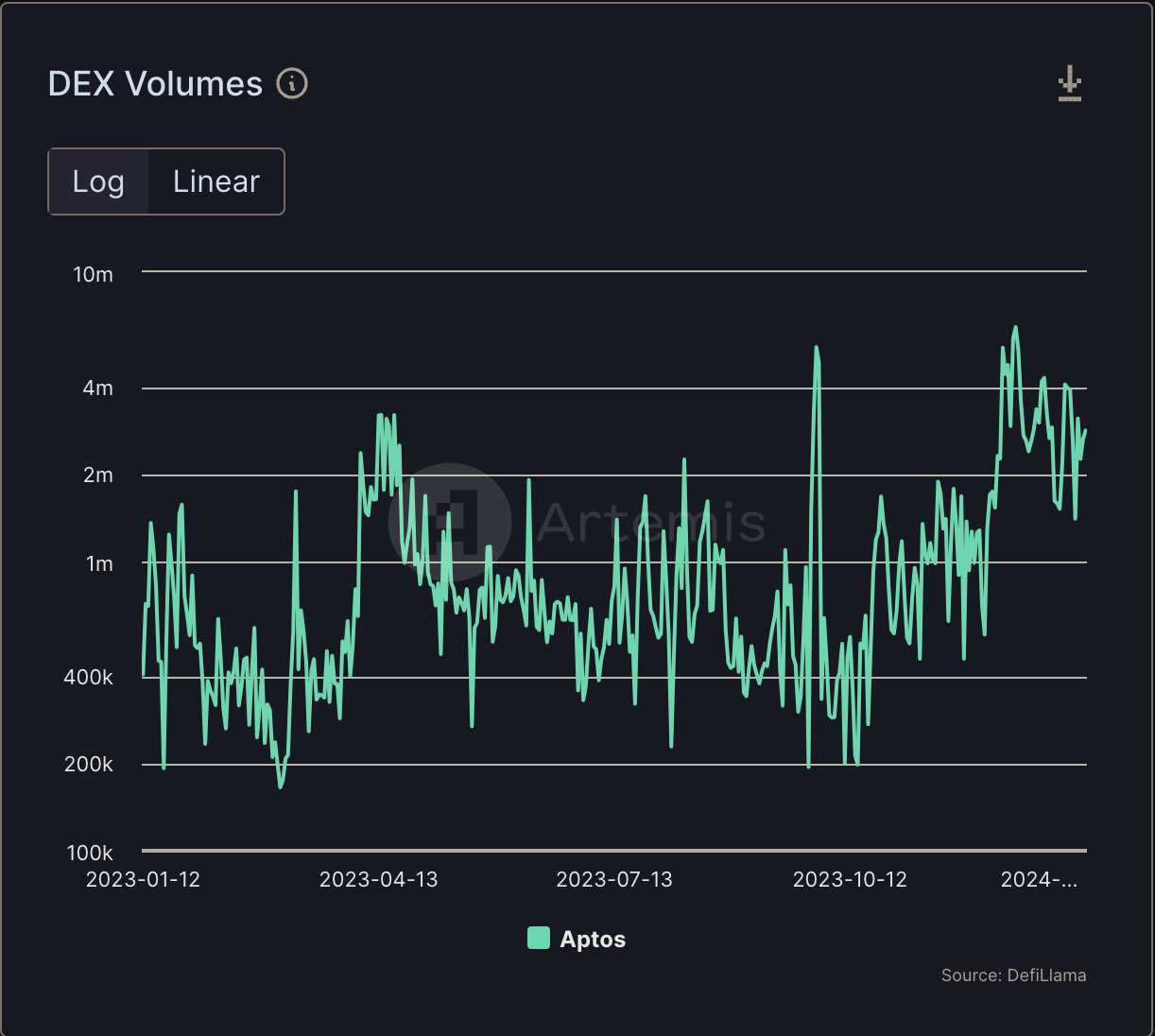

Understanding DEX Volume:#

The volume on a decentralized exchange (DEX) holds significance for any cryptocurrency as it reflects the activity and interest in the decentralized exchange market. It serves as an indicator of the liquidity and effectiveness of the DEX platform. A high DEX volume implies increased user engagement, more trading activities, and expanded opportunities for crypto investors. Conversely, a low DEX volume suggests fewer users, limited trades, and a potential slowdown in growth. Additionally, DEX volume has an impact on the price and volatility of a cryptocurrency, showcasing the supply and demand dynamics within the market.

DEX Volume by chain (data as of 12th Jan, source: Artemis)

DEX Volumes in Flux:#

The DEX volumes have experienced fluctuations over time, marked by two notable spikes in May and December. December 12, 2023, recorded the peak volume, reaching approximately $5 million, while the lowest volume dipped to around $0.2 million in March 2023. Despite the ups and downs, the overarching trend suggests an upward trajectory, signaling increasing interest and activity within decentralized exchanges.

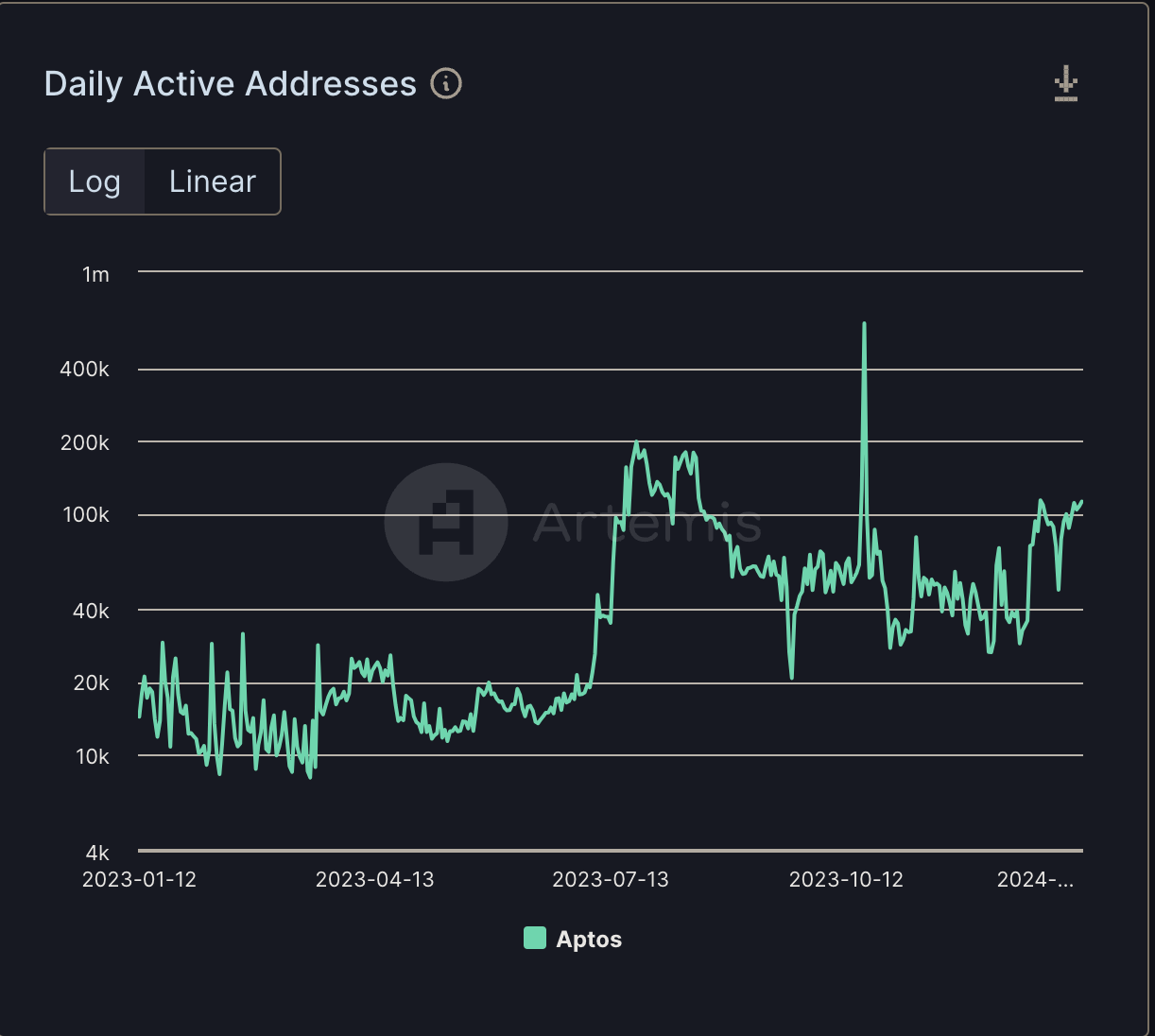

Daily Active-Addresses:#

Daily Active Addresses by chain (data as of 12th Jan, source: Artemis)

Daily active addresses provide insight into the number of unique addresses engaging in transactions on a network within a given day. This metric serves as a gauge for adoption, usage, and overall activity within a blockchain or coin.

For $APT, the daily active addresses have demonstrated a consistent increase over time, with occasional fluctuations and peaks. The pinnacle was reached in December 2023, recording approximately 1 million active addresses, while the lowest point was noted in April 2023, with around 10K active addresses. The overarching trend indicates a growing user base on Aptos, reflecting increased utilization of both the blockchain and the APT coin.

Total Value Locked (TVL):#

TVL by chain (data as of 12th Jan, source: Artemis)

Total Value Locked (TVL) is a metric that gauges the strength of the Decentralized Finance (DeFi) ecosystem by revealing how much value participants are willing to commit to DeFi contracts. The higher the TVL, the greater the confidence in DeFi. This measure is derived by summing up the total value of assets locked across various DeFi protocols. TVL is crucial as it signals the extent of adoption and usage within the DeFi space. Additionally, it aids investors and traders in evaluating the risks associated with DeFi investments. For DeFi projects, tracking TVL is vital as it provides insights into the level of interest and adoption their protocols are experiencing.

Aptos is currently witnessing an impressive Total Value Locked (TVL) of approximately 110 million USD, showcasing a remarkable and rapid increase at an average rate of 23%. This substantial growth reflects heightened confidence among users and traders, with a surge in investments and trading activities on the Aptos platform.

TVL hovers around $40–70 million all the time. The TVL recently hit an all-time high in December. This is suggesting a bullish indication as more money is being poured into the protocol.

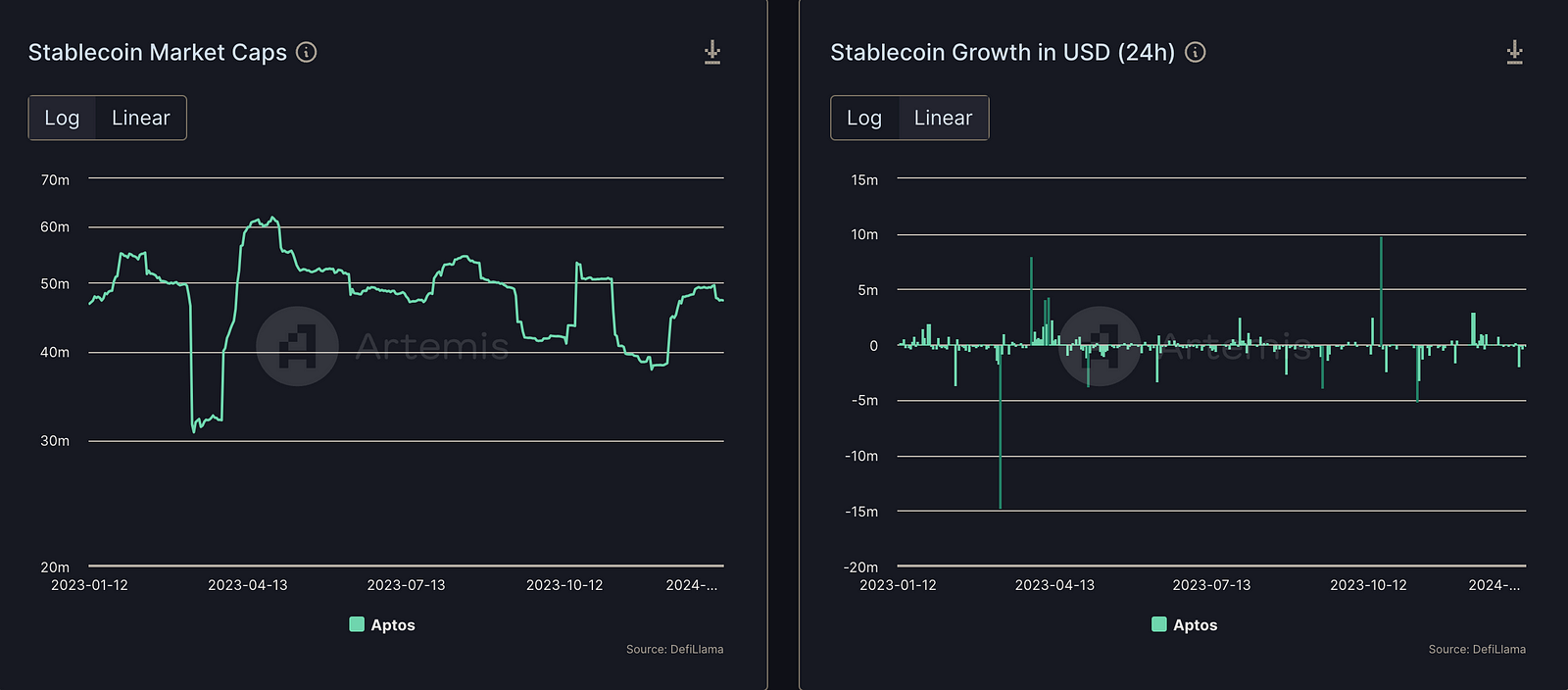

StableCoin Market on Aptos:#

Stablecoin Market by Chain (Data as of 12th Jan, Artemis)

In the vibrant world of Aptos, the stablecoin market stands out as a cornerstone, currently boasting a robust $50 million market cap that continues to grow. For new readers entering this dynamic ecosystem, stablecoins play a crucial role by providing a secure and reliable digital asset pegged to a stable value, often tied to traditional fiat currencies.

This $50 million market cap signifies the collective value of stablecoins circulating within the Aptos blockchain, showcasing the community's trust and adoption of these stable digital assets. As Aptos evolves, the stablecoin market promises stability and utility, laying a solid foundation for users to engage in secure transactions, investments, and various decentralized financial activities within this thriving blockchain ecosystem.

Move Dollar#

Move Dollar or MOD, is an Aptos-native stablecoin used to transact, facilitate, and interact with various other DeFi protocols in the ecosystem while acting as a store of value, a medium of exchange, and a unit of account. MOD is an over-collateralized, yield-bearing stablecoin backed by a basket of on-chain assets. Its diverse collateral base of liquid staked derivatives, liquidity pool tokens, deposit receipt tokens, and RWAs ensures its decentralized, censorship-resistant nature without compromising capital efficiency.

Now, let's delve into individual DeFi categories or themes, examining their strengths, limitations, and the opportunities they present. Let's explore a rich tapestry of exciting projects on Aptos, ranging from decentralized exchanges (DEXes) to liquid staking and lending-borrowing protocols, and uncover the innovations that are reshaping the landscape and contributing to the dynamic future of finance on Aptos.

The path forward with DEXs, CLOBs, and AMMs ⛓#

When it comes to trading in the decentralized financial realm, most users turn to decentralized exchanges (DEXs) and DEX aggregators. Let's explore the current landscape of decentralized exchanges (DEXs) on Aptos, delving into their functionalities, trading volumes, and the dynamic nature of the decentralized trading experience.

Among the notable DEXs on Aptos are Thala, LiquidSwaps, PancakeSwap AMM, and Sushi Aptos. These platforms stand out for their stellar performance, emerging as some of the most frequently utilized swapping hubs where users and traders engage in seamless token exchanges.

Thala Labs#

Thala is a decentralized finance (DeFi) protocol native to the Aptos blockchain. The protocol revolves around two key products: Move Dollar and Thala Swap.

TVL of Thala (Data as of 12th Jan)

Thala has become the most dominant DEX for Aptos, taking in over 74% of the total DEX volume, followed by Amnis, Aries, Liquid-Swap, and Tortuga.

Thala leads the charge in bringing Move Dollar to life on Aptos. With extensive research into existing stablecoins, the team is crafting Move Dollar (or "MOD") as an over-collateralized stablecoin. The goal is clear to address the challenges posed by the trilemma and offer a stablecoin that stands out in the crypto landscape.

AMM and Launchpad Overview on Thala:#

Thala Swap, a pioneering automated market maker, introduces dynamic pool weightings, supporting various pool types, including weighted, stable, and liquidity bootstrapping pools. This AMM protocol not only enhances use cases for MOD but also ensures deep and enduring liquidity, often without the need for additional incentives.

Diving into specifics, Thala's launchpad, a derivative of Thala Swap, harnesses dynamic pool weightings, notably the liquidity bootstrapping pool (LBP). This innovative approach powers Thala's third product, providing a secure and fair method for distributing tokens to both projects and market participants. Thala's launchpad emerges as a key player, facilitating a seamless token distribution process within a trustworthy framework.

CLOBs #

A Central Limit Order Book (CLOB) operates as a transparent trade execution model, prioritizing customer orders (bids and offers) based on a 'price/time priority' mechanism. This system stores outstanding buy or sell offers in a queue and executes them in a sequential order, prioritizing the entered price and time.

Ferum#

Ferum is an on-chain order book offering unprecedented control to liquidity providers in the Aptos Ecosystem

Ferum is an on-chain order book offering unprecedented control to liquidity providers in the Aptos Ecosystem

Econia#

Econia serves as the powerhouse behind Aptos DeFi, employing Move and Block-STM technologies to deliver top-tier performance, seamless integration, and maximum composability with various protocols. With its atomic matching engine taking advantage of Aptos' lightning-fast sub-second finality, trades are cleared instantly, and Econia's hyper-parallelized structure ensures web-scale efficiency by segregating state for different markets.

From spot trading to leveraged perpetual futures, Econia consolidates liquidity to enhance capital efficiency, offering developers and market makers a shared trading venue accessible from every corner of the ecosystem. As a secure, decentralized, and permissionless on-chain settlement engine, Econia stands as the foundational layer for the next era of DeFi, providing an open-source platform that spans the entirety of the digital asset landscape.

Liquid Staking Getting Hotter 🔥#

Liquid staking represents a capital-efficient approach that leverages staked assets as collateral, fostering increased participation and capital flow throughout the market compared to traditional financial systems.

Aptos boasts robust Liquid Staking Derivative (LSD) providers, allowing users to generate passive yields on their capital by depositing tokens into these LSD pools. These providers issue LP tokens, offering users versatile options for various operations, including restaking-a feature that enhances potential rewards on LP tokens. Major LSD providers on Aptos, such as Amnis Finance, Tortuga, and Ditto Finance, are pivotal players transforming the landscape of liquid staking within the Aptos ecosystem.

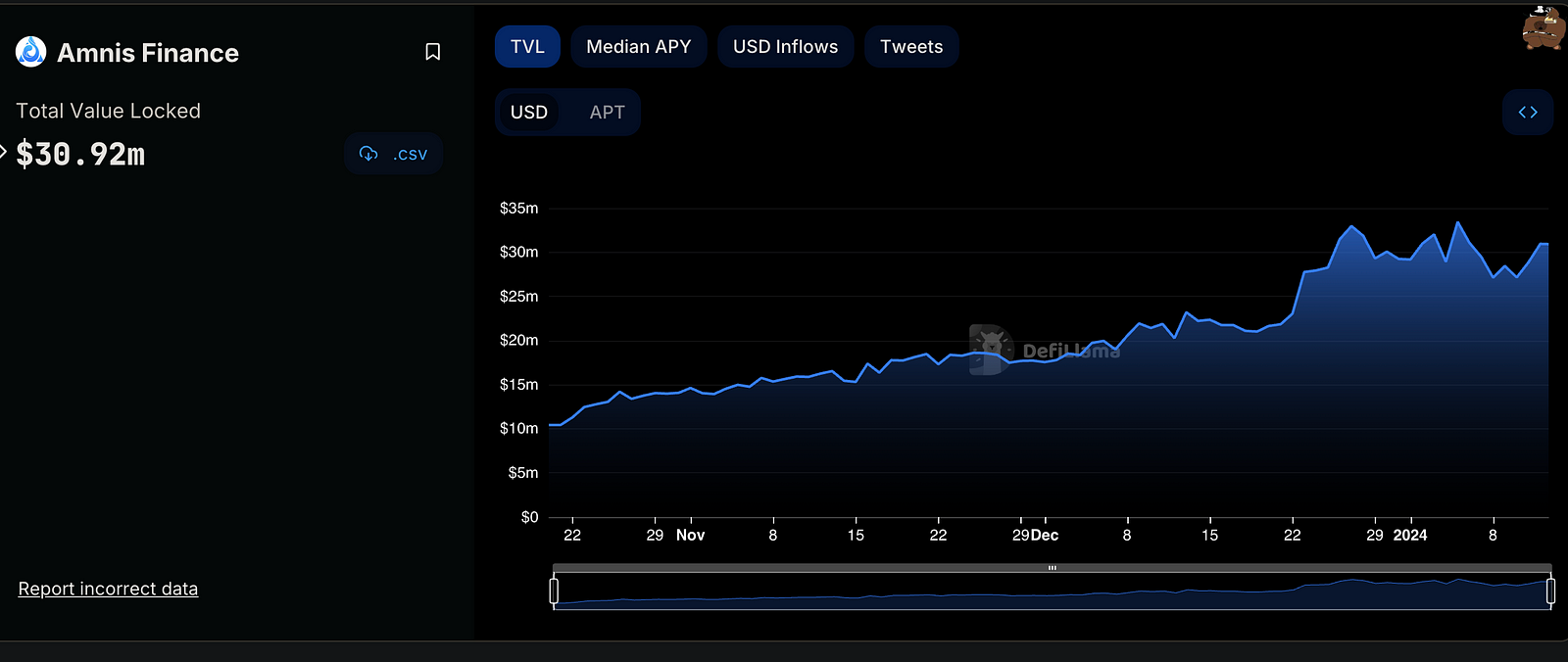

Amnis Finance - Pioneering Liquidity Staking on Aptos#

Amnis Finance brings a game-changer to the world of Aptos with its liquid staking feature. This means users can get tokens instantly that match the value of what they've staked. No need to wait for unstaking-you can use these tokens for transactions or other activities right away. Liquid staking gives users flexibility, allowing them to explore trading or investment opportunities without the hassle of withdrawing tokens from the Proof of Stake network.

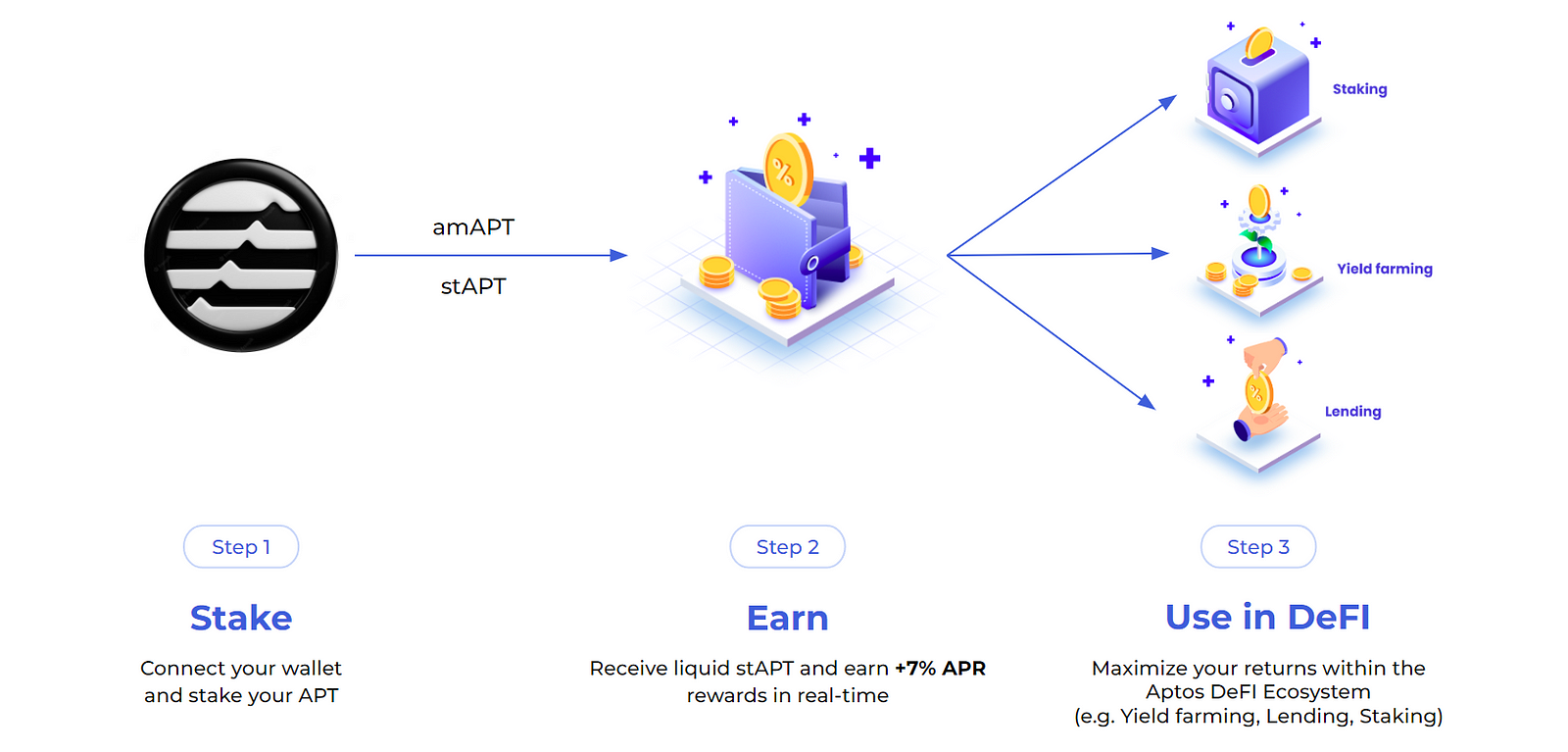

How does Amnis work?#

amAPT (Amnis Aptos coin) acts as a stablecoin loosely pegged to APT, so that 1 amAPT always represents 1 APT and the amount of amAPT in circulation matches the amount of APT in the Amnis Finance. When APT is sent to the Amnis Finance, an equivalent amount of amATP is minted.#

Margin Trading#

Margin trading on the blockchain enables you to increase your profit potential through leverage, or increased buying and selling power, on your trades. Using the increased buying or selling power from your existing balance can lead to potentially greater gains as well as greater losses from your trades.

Aptos, although relatively new to the scene, is making waves with the development of margin trading protocols. A standout example is Aries Market and Merkle Trade, offering a range of features like margin trading, diverse markets, lending, borrowing, and on-chain order books. This highlights Aptos' potential as a platform for cutting-edge financial solutions, proving that innovation is not restricted by the platform's newcomer status.

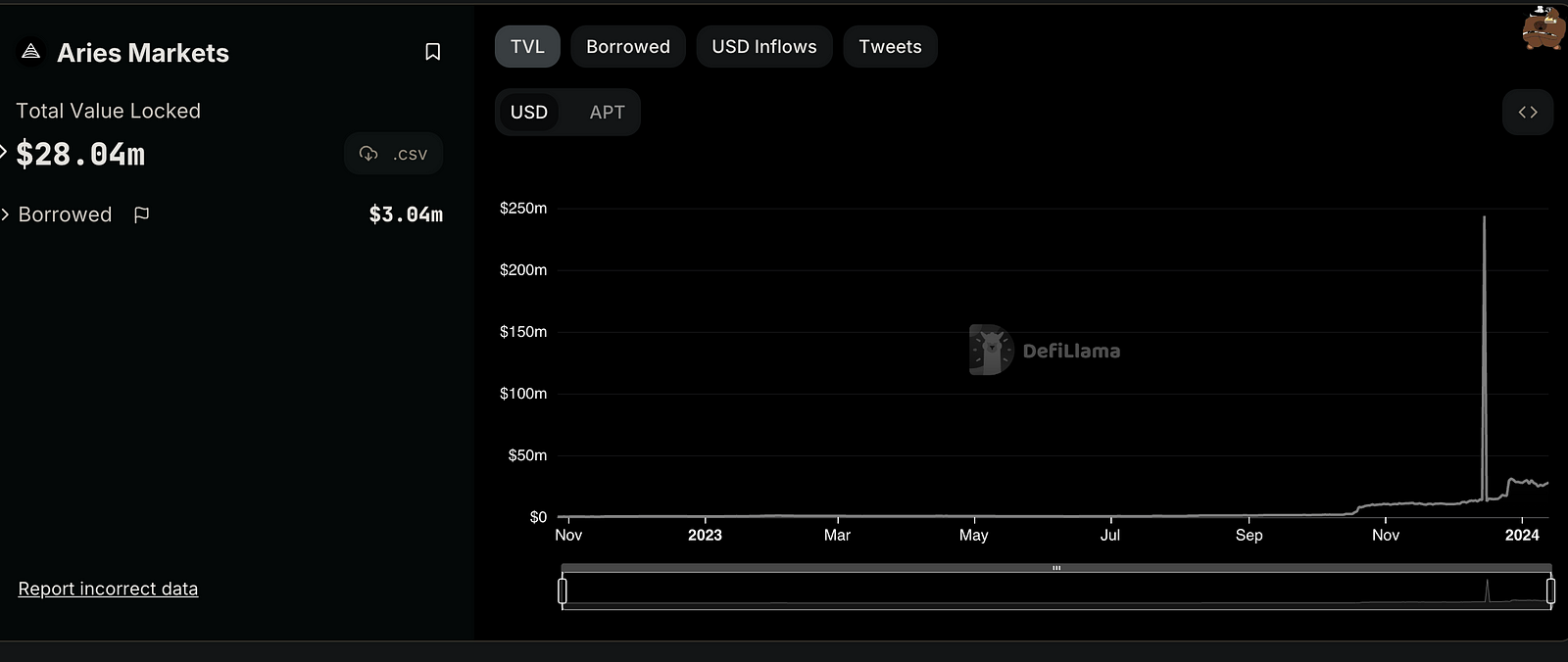

Aries Market#

Aries Market stands as a decentralized margin trading protocol within the Aptos Ecosystem. Enabling users to lend, borrow, and engage in margin trading, it operates through a fully on-chain order book, ensuring swift and efficient transactions.

With one unified margin account, users can earn interest on deposits, borrow from shared liquidity pools against collateral, swap with leverage at the best price, trade with margin via a fully on-chain order book, and access other Aptos DeFi products with ease. Aries Markets aims to provide users with a CEX experience that will allow them to borrow, lend, swap, and trade with margins via a fully decentralized orderbook and Automated Market Makers (AMM).

Aries Market Core Features:

- Lending and Borrowing

- Swap via underlying AMM

- Trade spot margin on CLOB

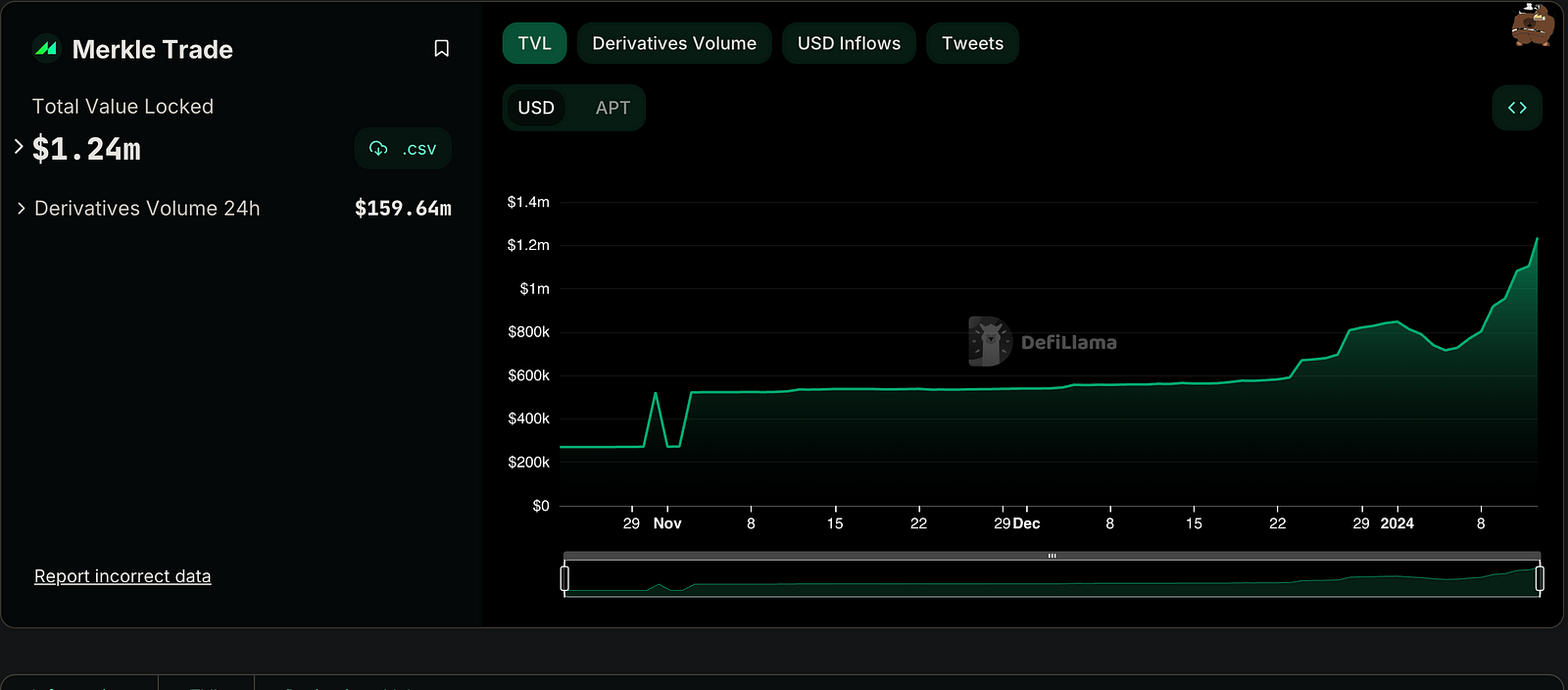

Merkle Trade#

Merkle Trade is a decentralized trading platform that offers crypto, forex and commodities trading with leverage up to 1,000x, along with access to advanced and user-centric trading features.

Why is Merkle Trade best for leveraged trading?#

Choosing Merkle Trade for decentralized leveraged trading provides traders with a best-in-class experience in the fast-paced world of crypto, forex, and commodities. With leverage options reaching up to 1,000x on forex and 150x on crypto pairs, Merkle Trade sets itself apart by offering some of the highest leverages in the market. The platform's commitment to diversity is evident in its comprehensive range of trading pairs, and it plans to introduce more assets in the future.

Leveraging the speed of Aptos, the lowest-latency production blockchain, Merkle Trade ensures fair price order execution with minimal slippage, providing traders with a highly responsive trading experience. Decentralized and non-custodial, Merkle Trade eliminates counter-party risk by allowing traders to interact directly with the liquidity pool ("Merkle LP") as the counterparty to every trade on the protocol. This ensures that all trades and settlements are executed by smart contracts, eliminating the need for custody of user funds at any point in time. Moreover, Merkle Trade boasts minimal fees, with trading fees starting as low as 0.05% for crypto pairs and 0.0075% for forex pairs at launch.

What's next for Aptos DeFi?#

The future of Aptos DeFi looks incredibly promising, marked by innovation and a user-focused approach. The stablecoin market, reaching an impressive all-time high market cap of $60 million, showcases the growing trust in stablecoins within the Aptos ecosystem. These digital assets, known for their stability, play a crucial role in facilitating secure transactions and various financial activities.

Key players like Merkle Trade, Aries Markets, and Amnis Finance contribute to the platform's growth. Merkle Trade introduces decentralized leverage trading with cutting-edge features, offering users flexibility with leverage options. Aries Markets, on the other hand, acts as an all-in-one decentralized application, blending spot-leveraged trading and money market activities in a user-friendly interface. Amnis Finance introduces liquid staking, providing users with flexibility in maximizing returns on APT tokens while maintaining liquidity.

Projects like Thala Swap and Move Dollar add depth to Aptos DeFi. Thala Swap enhances liquidity with its automated market maker, while Move Dollar addresses challenges in the decentralized finance space by offering stability and utility. As these projects unfold, Aptos DeFi is set for continued growth, promising enhanced user experiences and expanded functionalities, solidifying its position as a prominent player in the broader landscape of decentralized finance.

The introduction of new protocols set to launch in Q1 and Q2 of 2024 is a game-changer for Aptos DeFi and the overall Aptos ecosystem. These upcoming protocols in the DeFi space are essential for powering transactions, capital movement, and seamless token interactions within and outside the Aptos platform. As these protocols go live, they are anticipated to significantly boost the growth of Aptos DeFi, enhancing the overall Total Value Locked (TVL) and creating a more vibrant and interconnected decentralized financial environment.

Token Unlocks-2024#

What is token-unlocking?#

Unlocking tokens is a significant event in the cryptocurrency world, marking the release of previously restricted or locked tokens. This locking and unlocking process is commonly seen in scheduled releases or special events, playing a crucial role in effectively managing the distribution and flow of tokens in the crypto market.

Reasons for Token Locking:

- To prevent immediate selling and stabilize the price

- To incentivize long-term holding and project involvement

- To align the interests of developers and investors

Implications of February Token Unlock on APT Tokens#

In February, a token unlock event is on the horizon, unleashing a total worth of 24 million APT tokens. This release accounts for approximately 8% of the total APT token supply. The introduction of this additional supply to the market may potentially influence the price and liquidity of APT tokens, making it an event worth monitoring for market participants and observers alike. This unlock may further increase the selling pressure on APT tokens as more supply becomes available.

Conclusion#

As we navigate the intricate landscape of Aptos DeFi, the forthcoming months hold the promise of transformative growth and innovation. With the stablecoin market flourishing at an all-time high of 60 million, the platform's resilience and user trust are evident. Exciting projects like Merkle Trade, Aries Markets, and Amnis Finance introduce novel functionalities, providing users with diverse and powerful tools. The impending launch of new protocols in Q1 and Q2 of 2024 further underscores Aptos DeFi's dynamic evolution.

However, it's essential to approach the future with a nuanced perspective, recognizing factors like the upcoming token unlock in January. The injection of 24 million tokens into the market, constituting 8% of the total supply, has the potential to impact APT token prices and liquidity. As we move forward, staying vigilant and adaptable will be key, ensuring that Aptos DeFi continues to thrive as a hub for decentralized financial activities. With each development and challenge, Aptos solidifies its position as a vibrant and influential player in the broader decentralized finance landscape. The journey ahead promises further innovation, collaboration, and exciting possibilities for users and enthusiasts invested in the growth of Aptos DeFi.