Payments have come a long way, starting with the simplicity of cash transactions where parties trusted the physical exchange. However, as our world became more connected, centralized payment networks like Visa, Mastercard, PayPal, and others emerged to facilitate seamless global transactions. While these networks provided convenience, they also brought forth a new set of challenges, including high fees, privacy concerns, and reliance on intermediaries, leading to issues of censorship and control.

Amidst these challenges, Bitcoin emerged as the pioneer of blockchain technology and decentralized payment networks. This marked the beginning of a transformative journey for the financial landscape. As the blockchain space evolved, advanced solutions like various protocols and various L1s and L2s like Ethereum, Solana, Polygon etc followed suit, further refining decentralized payments. These innovations unlocked unprecedented levels of security, scalability, and efficiency, reshaping the way we handle money. The future of payments is steadily moving towards a decentralized, secure, and borderless paradigm.

The Evolution of Web3 Payments:#

The first generation of decentralized payment networks, represented by Bitcoin and early cryptocurrencies like Litecoin and XRP, introduced the concept of trustless peer-to-peer transactions. Utilizing public ledgers and immutability through blockchain technology, they offered a more seamless option for digital transfers compared to traditional banks. However, these early cryptocurrencies faced challenges in gaining widespread adoption as payment methods due to high valuation volatility, slow transaction processing speeds, and limited acceptance. Nonetheless, they served as the catalyst for the development of subsequent generations of crypto innovations.

The second generation of decentralized payment networks ushered in Programmable Layer 1 solutions and stablecoins, exemplified by protocols like Ethereum and the emergence of Stablecoins like Tether, USDC, and Dai. These advancements sought to address scalability and transaction speed issues, making cryptocurrencies more viable for everyday payments. While these technologies have shown immense potential in various industries, they still pose challenges in mainstream adoption. The need to set up crypto-based wallets to hold digital assets and facilitate payments can be a barrier for many users who are not familiar with the intricacies of the crypto ecosystem. Additionally, the infrastructure was not equipped to fully support frictionless and seamless transactions, leading to potential usability and user experience hurdles.

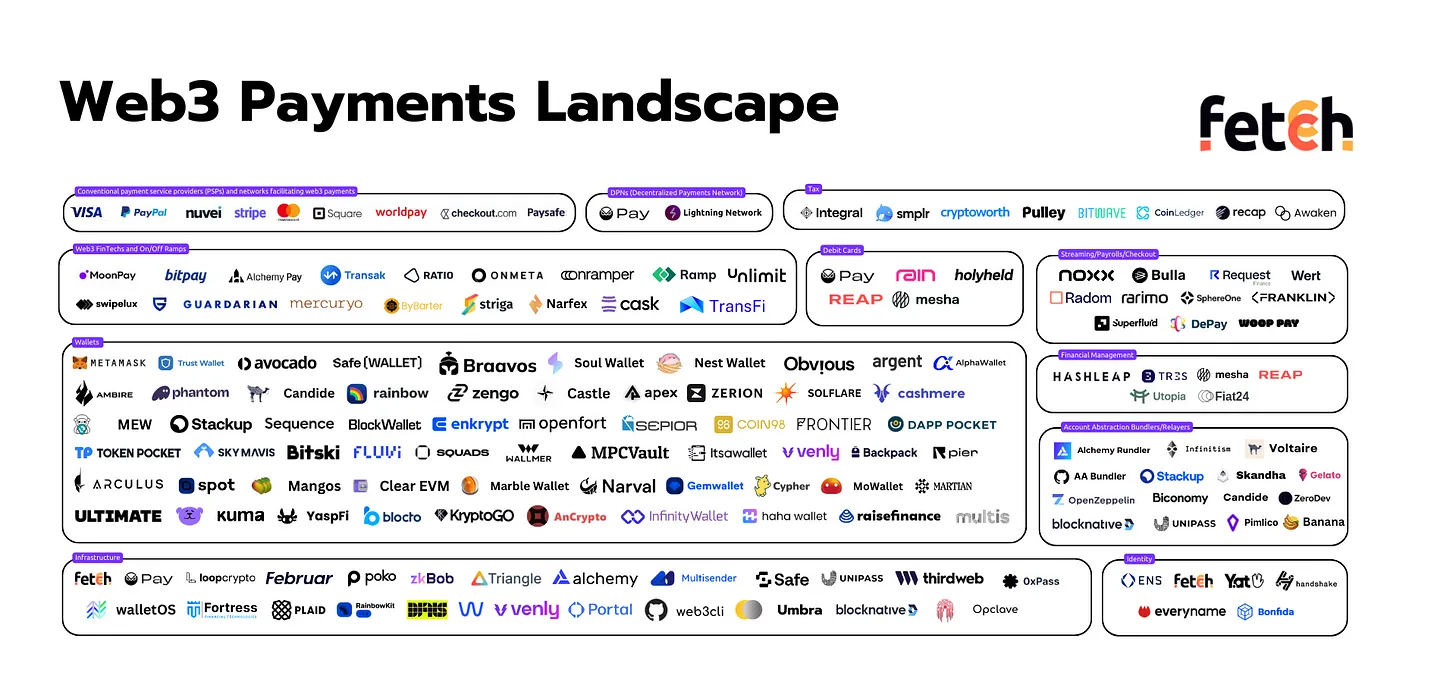

According to a report by Nuvei, in 2021, over 95% of C2B (consumer-to-business) crypto commerce volumes were attributable to the on-ramping and off-ramping of fiat to crypto via crypto exchanges and wallets. Specialized fintech companies offering fiat on-ramps, where users can buy cryptocurrencies in exchange for fiat currency, have emerged and have played a significant role in facilitating this volume (e.g., Bifinity, Ramp, MoonPay, Wyre). Traditional payment service providers (PSPs) have also thrived by supporting these volumes (e.g., Checkout.com, Nuvei, Worldpay).

This trend reflected the initial stages of the transition to decentralized payment networks (DPNs), where the majority of crypto transactions involved exchanging fiat currency to enter or exit the crypto market.

Now, we find ourselves in the era of the next generation of decentralized payment networks. This generation is marked by dedicated Layer 2 solutions and protocols built on top of secure Layer 1 networks, such as Ethereum and Bitcoin. These innovations are driving a radical shift in consumer and merchant perceptions, further accelerating the usage of DPNs. As the world continues to embrace digital innovations, there is a pressing demand for improved crypto-commerce payments in the coming years. Addressing these challenges and creating frictionless experiences in the crypto payment space holds tremendous long-term potential for payment providers to thrive and drive user-centric advancements in the financial landscape.

Case Study: Gnosis Pay#

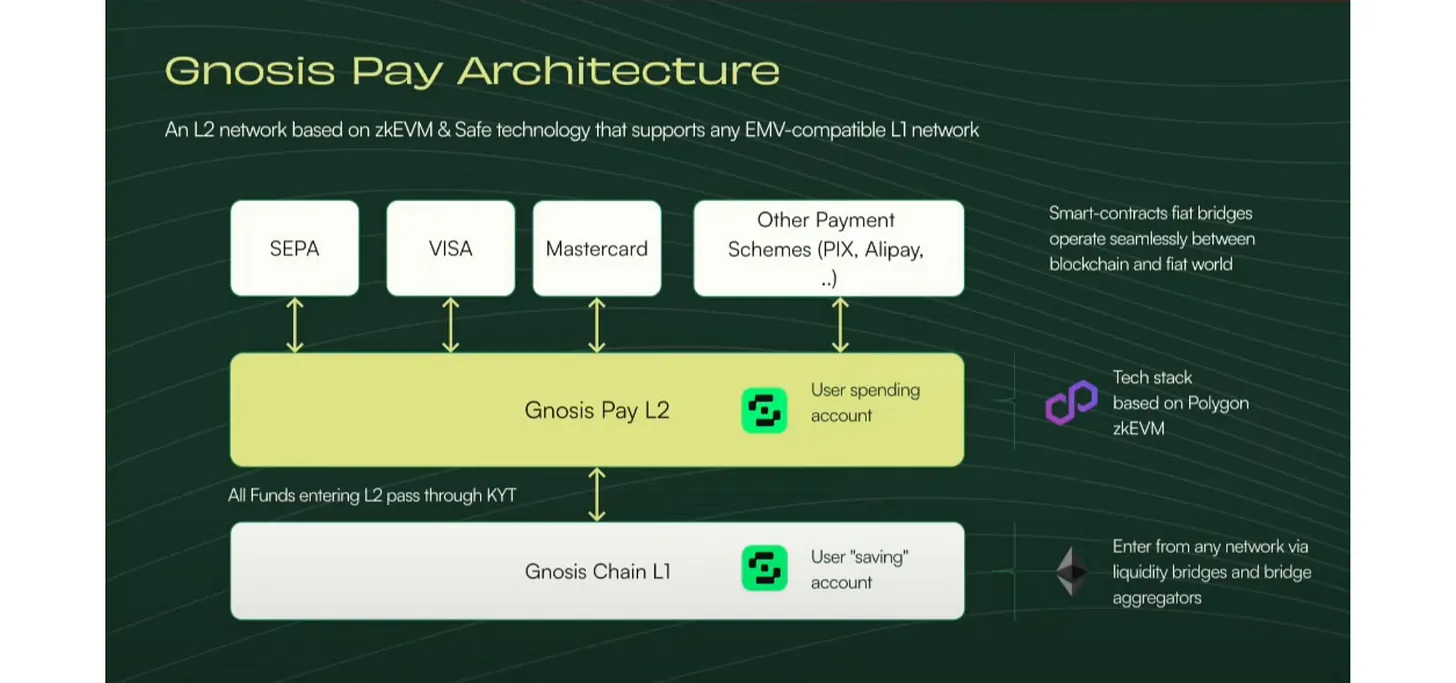

n the evolving landscape of decentralized payment networks, Gnosis Pay emerges as a third-generation solution, aiming to revolutionize DPNs by integrating with traditional payment processors. It offers Gnosis Card, a Visa-certified consumer debit card directly linked to a self-custodial on-chain wallet, making Safe wallets function as user bank accounts. This integration with traditional financial systems bridges the gap between the crypto world and mainstream commerce, bringing convenience to users and merchants.

Gnosis Pay offers developer tools for cryptocurrency wallets to create their own version of Gnosis Card, eliminating the complexities of building an online payment system and generating additional revenue for Gnosis. The payment solution is built on the secure Safe smart contract wallet infrastructure. Users have separate accounts on Gnosis' Layer 1 chain, which functions as a savings account, and on Layer 2 chain, which functions as a spending account.

Funds transferred to the Layer 2 account undergo thorough AML and CFT compliance screening, ensuring only approved funds can be used for transactions through the Visa network. Users have full control over their Safes and can transfer funds back to Layer 1 at any time. Despite the technical complexities, Gnosis aims to offer a seamless experience, making decentralized payments as convenient as traditional credit cards. This groundbreaking approach has the potential to transform the financial landscape, providing security, efficiency, and user-friendly experiences in the world of crypto-commerce.

The Evolution of Decentralized Payment Networks has indeed brought about significant advancements in the financial landscape, offering solutions to long-standing issues with traditional payment systems. The move towards Layer 2 solutions and protocols like Gnosis Pay presents promising opportunities for improved scalability, efficiency, and user experience.

The Challenges:#

Decentralized Payment Networks (DPNs) face challenges in their journey towards widespread adoption. While the integration of traditional payment processors through solutions like Gnosis Pay can bridge the gap between crypto and mainstream commerce, it may also bring regulatory and compliance challenges. Striking the right balance between innovation and regulatory compliance will be crucial for the future success of DPNs. Key hurdles include managing the risk associated with cryptocurrency volatility, building trust among consumers and merchants, ensuring regulatory compliance, addressing security concerns, and enhancing the scalability of blockchain networks. User education and familiarity, along with the complexities of tax and accounting for cryptocurrency transactions, also pose significant challenges. Overcoming these obstacles will be crucial to realizing the full potential of DPNs and revolutionizing the financial landscape with secure, efficient, and borderless payment solutions.

The Impact:#

Decentralized Payment Networks (DPNs) are revolutionizing cross-border payments and remittances, offering a transformative solution to long-standing challenges in international transactions.

Streamlining Cross-Border Payments and Remittances:

Decentralized Payment Networks (DPNs) paired with good on/off ramps are poised to disrupt the cross-border B2B payment space, revolutionizing traditionally slow, costly, and complex transactions. With their speed and efficiency, DPNs offer a game-changing solution for cross-border payments. What previously took several days to settle can now be completed within minutes, breaking geographical barriers and benefitting businesses of all sizes, fostering global trade, and enhancing cash flow.

The adoption of crypto payments is on the rise, with approximately 3.3 million US adults projected to pay with crypto in 2023, and a worldwide crypto payment value expected to reach $9.28 billion, according to a report by insider intelligence.

In addition to transforming the B2B payment landscape, DPNs are also revolutionizing remittances, the funds sent by individuals to their families and friends abroad. Traditional remittance methods are complex, expensive, and time-consuming, but DPNs provide a faster and more cost-effective alternative. Cryptocurrencies like Bitcoin or Ethereum can significantly cut the cost of sending money internationally, reducing expenses by about 96.7% compared to the current system. With an average wait time of just 10 minutes, crypto transfers outpace the traditional international wire transfers that can take 1 to 10 days. This efficiency and accessibility can profoundly impact the lives of the estimated 1 billion people who rely on remittances, empowering them with faster and more affordable cross-border transactions.

Cost Savings in Cross-Border Payments and Remittances:

Another significant impact of DPNs in the cross-border space is the potential for cost savings. Traditional cross-border payments and remittances often come with high transaction fees, foreign exchange costs, and intermediary charges that can eat into the overall payment amount. In contrast, DPNs, especially those with lower transaction fees and direct peer-to-peer transfers, can significantly minimize these costs. For example, the average remittance fee through traditional channels is approximately 6.18%, which translates to an estimated $12 billion spent by Americans on remittance fees annually. DPNs can cut these costs by about 96.7%, making international money transfers significantly more affordable for individuals and businesses alike.

Enhancing Point-of-Sale (POS) Experiences:

DPNs also hold the potential to enhance point-of-sale experiences in physical retail locations. By integrating crypto payment options, consumers are presented with more choices, enabling them to use their digital assets for purchases. For merchants, accepting DPNs can lead to increased sales, particularly among tech-savvy customers who prefer crypto-based transactions. This integration of DPNs at POS terminals can lead to a more convenient and seamless shopping experience, further driving mainstream adoption of cryptocurrencies in daily transactions.

The Value of Cross-Border Payments and Remittances:

The impact of cross-border payments and remittances extends far beyond individual transactions. They play a vital role in supporting economic growth, providing additional income, and acting as a form of social insurance for underbanked communities. The global value of remittances stands at approximately $781 billion, with countries like India, China, Mexico, and the Philippines receiving substantial remittance inflows. By reducing barriers, minimizing fees, and increasing accessibility, DPNs can strengthen the value of cross-border payments and remittances, enhancing the overall well-being of recipients and their communities.

As DPNs continue to evolve, they hold enormous promise in streamlining cross-border payments and remittances, addressing long-standing challenges, and fostering a decentralized, secure, and borderless paradigm for the future of payments.

Conclusion:#

In conclusion, the evolution of payments from cash transactions to centralized payment networks and now to decentralized payment networks (DPNs) has been transformative for the financial landscape. Bitcoin and other early cryptocurrencies paved the way for secure peer-to-peer transactions, while Layer 1 solutions and stablecoins addressed scalability issues.

Now, with the emergence of the next generation of DPNs, marked by dedicated Layer 2 solutions and protocols, the potential for seamless, secure, and borderless transactions is within reach. However, challenges remain, including regulatory compliance, security concerns, and user education. Overcoming these obstacles is crucial for the widespread adoption of DPNs and their positive impact on cross-border payments and remittances.

The integration of traditional payment processors with DPNs, as exemplified by Gnosis Pay, bridges the gap between the crypto world and mainstream commerce, making crypto payments more accessible. As the world embraces digital innovations, the demand for improved crypto-commerce payments will continue to grow, providing payment providers with opportunities to thrive in this evolving financial landscape.

Overall, the future of payments is heading towards a decentralized, secure, and borderless paradigm, where cryptocurrencies play a central role in transforming the way we handle money and conduct transactions globally.